You’ve probably heard that having a good credit score increases your chance of successfully applying for a mortgage. Credit scores show lenders, mortgage companies, and the bank whether or not you have a good track record of paying back your loans on time. These scores can often be a barrier to homeownership for many people, and it’s important to know and manage your credit score.

Even though credit scores are important, there are a lot of myths out there that can harm your pursuit of a new home. Due to misinformation and fear mongering, you may have already discounted yourself from ever being a homeowner.

Use these myth busting tips if you are looking for a clear and simple home buying experience as you search for the house of your dreams.

1. Does Frequently Checking Your Credit Score Harm Your Credit?

There is something called a “hard inquiry” or “hard check” that can affect your score, the kind of check that a company does when you’re applying for a loan on a car or a home. Most of the checks you do on your own are soft checks and don’t actually harm your credit.

Hard checks happen when a lender looks into your credit, when you’re applying for a credit card or a mortgage. This negative effect is temporary and should bounce back quickly after the initial check.

Soft inquiries don’t affect your score whatsoever. If you use Equifax, Experian, or TransUnion to check or monitor your score over time, this is actually beneficial in the long run. Frequent soft credit checks will help you track your progress as you build credit, pay things down on time, and attend to any potential problems.

Using Credit Karma or other websites to check your credit score is a good and free way to make a soft check.

2. Closing Credit Cards Improves Credit Score And History

This one is a pretty substantial and common myth. Closing a credit card will hurt your score in the long run, as you typically need a credit line open to maintain your score. Some percentage of your credit score comes from the length of time you’ve had a credit history, and you could be negatively affected if you close a card you’ve had for a while. The longer you build an avenue of credit, the better your score will be. It’s better to pay down a card and leave it open instead of closing it completely.

3. The Balance On Your Card Affects Your Score

Your credit card balance increases over time because of the interest you owe and how it accumulates. Your credit score doesn’t naturally rise, and the balance on your card can potentially lower your score as you pay interest. Lingering balances affect the rate at which you use your credit car. The higher your balance the higher your rate, which can hurt your score.

4. Does Marriage Affect Your Score?

After you and your partner get married, you’re still considered individual entities. Your credit scores and card histories remain separate, and even if you marry someone with good credit it doesn’t mean it will fix the bad. Inversely, bad credit won’t bring someone else down just because they marry into it.

Still, when you file an application together for a mortgage, your credit scores will be checked and considered by the lenders as they are. A good score won’t cover a bad one, and so it’s important to make sure you and your partner both have good scores when looking to buy a home.

5. Good Income, Good Credit Score

There is a myth that your income directly affects your credit score, but your score doesn’t actually take your income into consideration. Your income isn’t considered or included on credit reports. The only thing that affects your credit is how it is used.

All FICO scores are influenced by payment history, amount owed, credit card history, new credit, and variety of credit. A job with a good salary will help you pay down your balances and improve your credit, but your credit score itself is based on how you’ve managed credit in the past. If you have a bad history of managing credit, even a good income won’t fix that.

Lenders assess your total earnings and your credit as separate things when you’re applying for a mortgage, and this happens in the pre-approval process. It doesn’t matter how much you earn, so making payments on outstanding balances to improve your score is a good idea if you’re applying for a home.

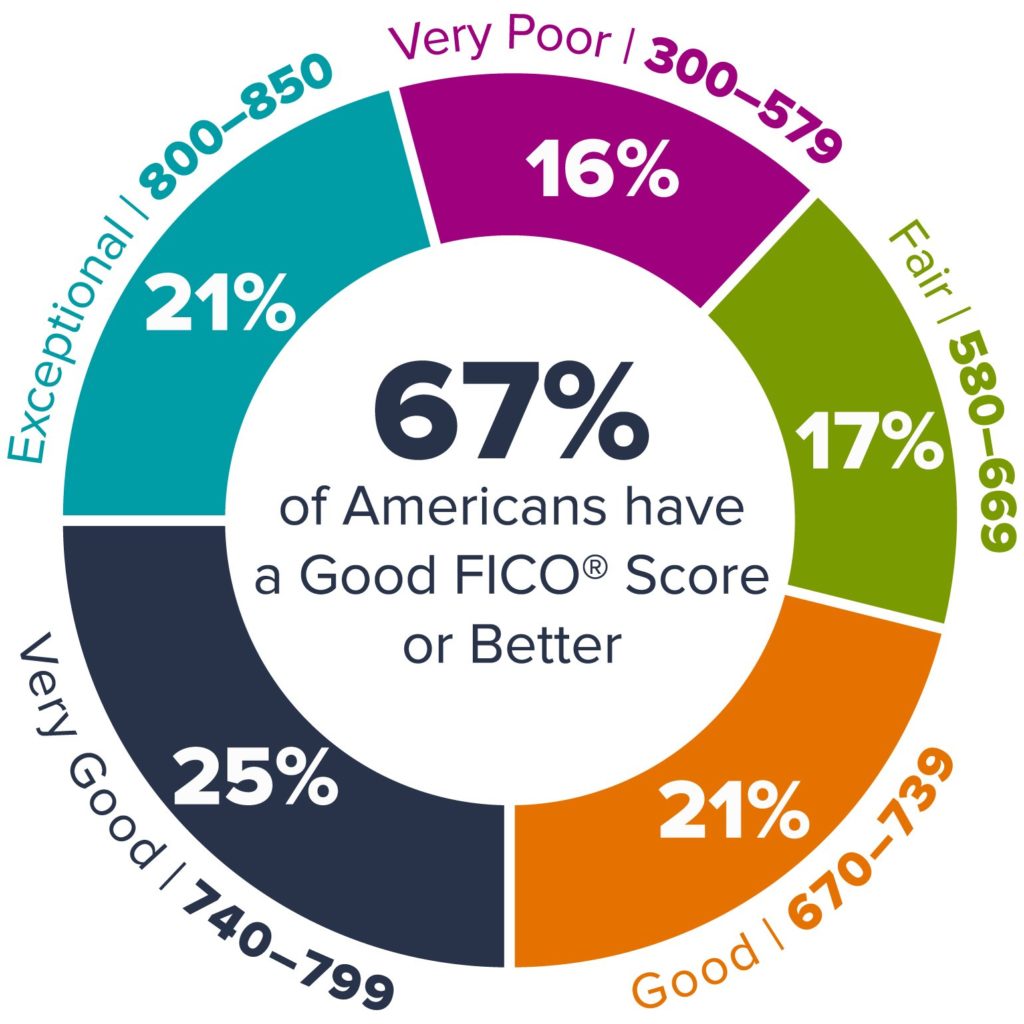

6. Does A “Perfect Credit Score” Actually Matter?

While you may feel like you’ve earned some bragging rights for having a credit score above 800, there aren’t actually any benefits for having a perfect score. There aren’t elitist products, loans, or credit bonuses for people with a perfect score, and once your score is considered good, you achieve the benefits that everyone else has. When looking to apply for a mortgage, it’s a good idea to try and get your score to 760 or higher. If you land there, you’ll qualify for just about everything.

7. Student Loans Affect Credit

If you think your student loans aren’t bringing down your credit score, think again. Your credit is impacted by more than just your credit card bills, it’s also impacted by the bills you pay over time, such as medical bills and student loans. If you were to default on your loans, you’ll see how much it can impact your credit. Set up an autopay system, hopefully at a discount, to pay off the interest on your student loans so it doesn’t negatively impact you when you look for a home.

As You Look For Your Home, Stay Positive

It can be difficult looking for your ideal home, especially when you’re looking for the perfect neighborhood to match. While you’re checking out the parks, restaurants, jobs, local pediatric dentists, doctors offices and more that will be the background of your new life, stay optimistic. Continue to pay off your balances and check in on your credit score as you look for your dream home, and you’ll be able to successfully apply for that mortgage before you know it.

We love to highlight like minded people! Check out more about this article’s author, Alison Brown:

Alison Brown is the Marketing Strategist at Children’s Dental Fun Zone. She has been inclined towards oral care since her childhood as she comes from a family of dental backgrounds. She loves spending time with kids and contributes her insights by writing and promoting informative blogs for families to help them adapt to their new homes and localities without any hurdles.